Welcome to our monthly investment catch up. In this edition we discuss what went well in the markets last month, what captured the attention of our investment team, and we share insights into some of the actions the investment team took in the portfolios.

What went well in November?

- The OCR cut provided relief – The Reserve Bank lowered the Official Cash Rate, which signalled more confidence that inflation is easing and helped support both shares and bonds.

- Inflation continued to cool – Local price growth eased again, which helped protect the real value of savings and reduce pressure on household budgets.

- NZX held steady – Local company earnings were generally solid, helping growth-focused funds maintain momentum.

- Tech stocks riding high – AI demand spilling into chipmakers, cloud platforms, and robotics firms pushed tech stocks higher.

- Global bonds strengthened – Easing monetary policy, particularly rate cuts by the U.S. Federal Reserve and other central banks, supported government bonds during the month.

What captured our attention?

- Household budgets still tight – Even with easing inflation, groceries, rents and insurance costs remained high for many families.

- Patchy retail spending – Slower spending in the past month may start to affect company earnings and limit momentum in the local share market.

- Tech sector volatility offshore – Big price swings in global tech and AI-focused companies created more uncertainty. Because these companies now make up a large part of global markets, any sharp drop could affect many KiwiSaver funds, not just higher-growth ones.

- Global political tensions – Ongoing conflicts and trade risks continued to threaten markets and lift costs for imported goods.

- Mixed performance in export markets – While dairy stabilised, log and horticulture demand remained uneven across key trading partners.

Market Commentary.

November was encouraging for New Zealand investors. The Reserve Bank cut the Official Cash Rate again, signalling more confidence that inflation is tracking the right way. Banks began trimming some mortgage rates, easing pressure for households and lifting sentiment heading into summer.

Local share markets were steady, helped by strong tourism and firm demand in parts of the rural sector. Dairy prices stabilised, meat exports held up well, and the NZ dollar strengthened slightly against some currencies, reducing the cost of some imported goods and limiting currency swings.

Overseas markets were mixed but mostly supportive, with slower global inflation helping settle volatility. Overall, the month provided a more stable backdrop for investors.

For members, the mix of lower interest rates and steadier markets helped lift confidence across most fund types. The month showed how different parts of a KiwiSaver fund respond to changes in the local economy and why results can vary between conservative, balanced, and growth options.

What this means for your portfolio.

Our investment team continued to focus on the fundamentals in November and how the various factors, which may include: inflation, tariffs, AI technology and global conflicts, impacted on the investments. The funds have been enjoying positive outcomes this year, but we all know from experience that markets are cyclical and move both up and down. Our investment team takes a disciplined approach, watching corporate earnings, looking at valuations, considering the risks and prioritising the factors that matter. Our objective is always to help our members prepare for and protect their future financial wellbeing, through the highs and the lows of the markets.

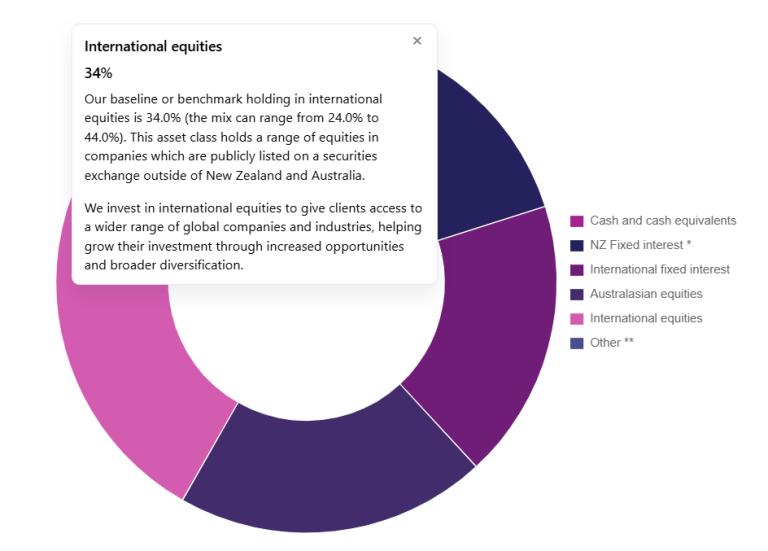

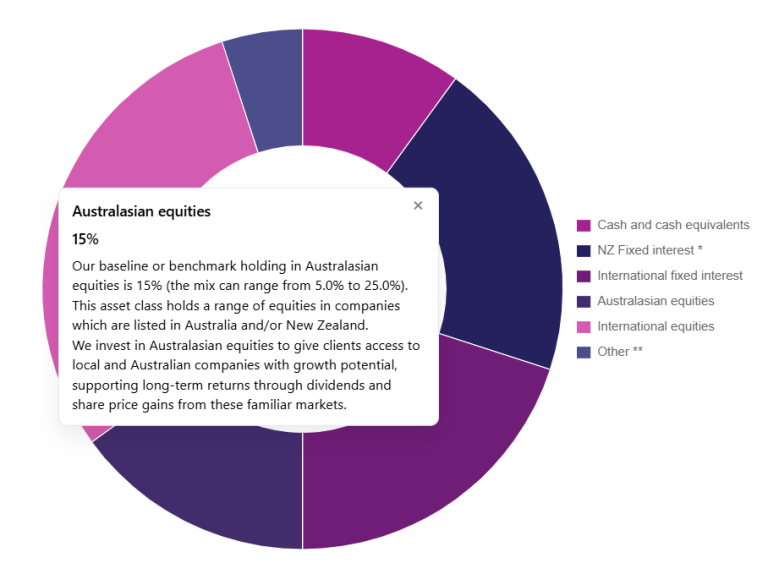

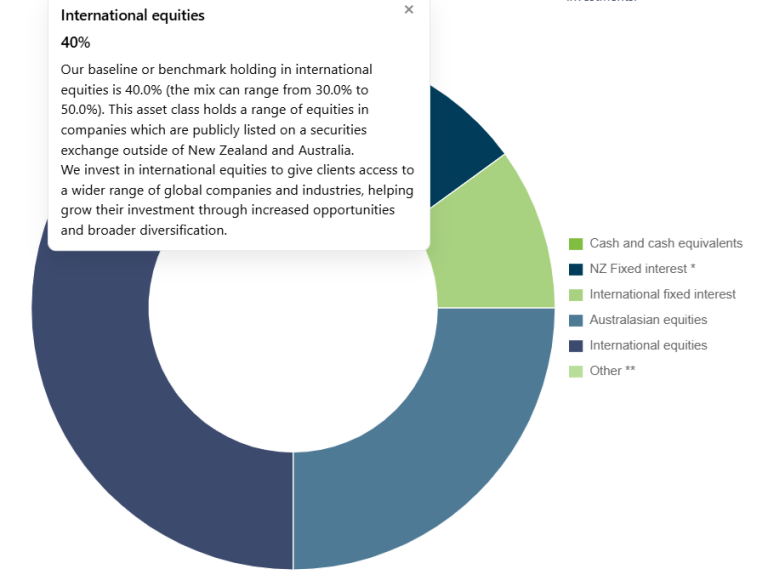

Where is your money invested?

Did you know that you can now see where your money is invested on our new website? On each fund page, we have a donut graph. If you click on the segments, you can see the breakdown of investments in each fund. Try these links:

Pension Fund | Anglican Financial Care

Retire Fund | Anglican Financial Care

Christian KiwiSaver Scheme Growth Fund

The New Zealand Anglican Church Pension Board trading as Anglican Financial Care is the manager and issuer of Christian KiwiSaver Scheme, The Retire Fund and The New Zealand Anglican Church Pension Fund. Product Disclosure Statements and Fund Updates are available on the Forms and Documents page of the AFC website https://angfincare.nz/news-and-knowhow/forms-and-documents/