What makes up the return on your Christian KiwiSaver Scheme investment? There are two parts to this and one of them relies on us to give the investment a helping hand.

A return on any investment is made up of:

- Market movements — the ups and downs of the investments Christian KiwiSaver Scheme holds.

- Your contributions — the money you personally put in, including the savings you make regularly.

Most people obsess over #1 and take #2 for granted. We all wish for double-digit gains every year, but markets don’t work that way, and sometimes the value of a Christian KiwiSaver Scheme fund falls. So, what can you do to improve your outcome?

Keep contributing to KiwiSaver for as long as you can. That’s the part within your control.

If you’re retired and drawing down your savings, this might not apply (although you may be able to lengthen the period in which you draw down your savings), but if you’re building your future, or want to help someone just starting out, read on.

A Surprising KiwiSaver Stat

According to the KiwiSaver Annual Report 2025, a big chunk of KiwiSaver members aren’t actively contributing at all. While total membership sits around 3.4 million people, about 40.6 % of members are not contributing, and among working-age members (18–65) roughly 30 % aren’t contributing at all, that’s not including retirees or kids accounts.

That means millions aren’t tapping into one of the easiest ways to grow their savings — simple dollar-in contributions that benefit from compounding over time.

Why Contributions Matter More Than You Think

Let’s make this real with an example.

Scenario 1

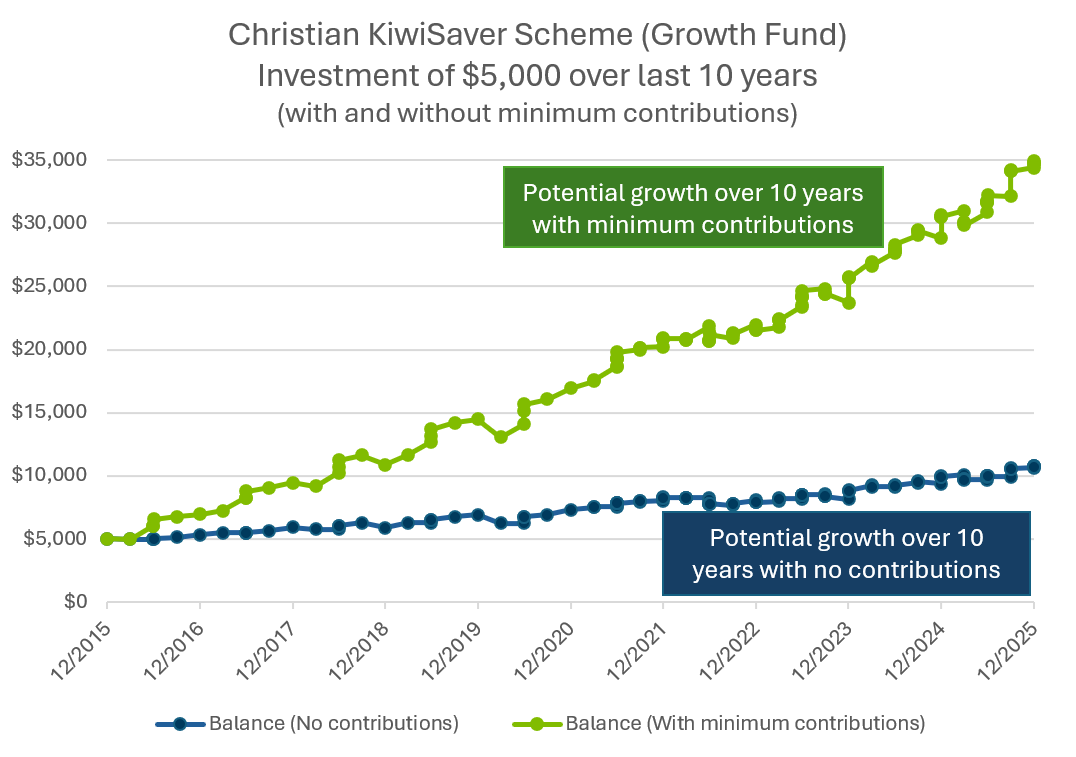

Let’s imagine you put $5,000 into the Growth Fund in Christian KiwiSaver Scheme 10 years ago and left it to grow, with no further contributions. How might that look?

As you can see on the graph, you may have increased your investment to around $10,700 at the end of the 10 years.

Scenario 2.

If on the other hand, you had started contributing the minimum amount of just over $20 per week, or $1,042.86 per annum, and received the full government contribution of $521.43 each year, the picture might be very different. If you look back at the graph, you can see that total may be closer to around $34,600 after 10 years, a significant improvement to the first scenario.

The returns shown below are after fees and tax and for illustrative purposes only.

We can expect the next 10 years to be different with the reduction in the government contribution, however that does not detract from the obvious. Contributions matter, even small ones.

So, What Should You Do?

What are the take-outs for you?

- Check your contribution rate. Even minimum contributions grow faster than nothing, but increasing it a little can make a big difference over a working life.

- Make contributions consistently. Markets are unpredictable. You can’t time them, but if you are consistent with your savings, market movements will have less of an impact.

- Aim to hit the government contribution threshold each year. That’s money for just showing up!

A Quick Reality Check

It’s ok if you’ve paused contributions for a while. Many people do this when life gets busy or finances are tight. But if you’re able to contribute, regular contributions are one of the most effective ways you can take control of your future.

Final words

At the end of the day, KiwiSaver rewards action. Contributing regularly is one of the simplest ways to boost your long-term returns without taking on extra risk. It helps you capture extra money, grow your savings faster, and build real momentum toward your first home or retirement. If you want a better outcome, the most reliable strategy is simple: put something in and keep doing it.

To learn more about Christian KiwiSaver Scheme visit our website: Christian KiwiSaver Scheme | Anglican Financial Care

Christian KiwiSaver Scheme, The Retire Fund, and the New Zealand Anglican Church Pension Fund are managed and issued by The New Zealand Anglican Church Pension Board (trading as Anglican Financial Care). The Product Disclosure Statements can be found here: https://angfincare.nz/news-and-knowhow/forms-and-documents/

The above information is for information purposes only and is not financial advice. Past returns are not a guarantee of future returns. We recommend you seek advice from a licensed financial advice provider when making decisions about your investments.